Lexden Capital has over 30+ years of expertise in capital markets, asset management, and loan origination/underwriting. As a conduit to the capital markets with a wide variety of investors, we pride ourselves in our ability to structure financing for complicated transactions efficiently and expeditiously and close a variety of commercial real estate loans with competitive pricing and efficient underwriting.

EB-5 Financing

Low cost loans to projects, typically in the middle of the capital stack for qualifying projects utilizing an extensive overseas network of marketing agents and immigration counsel.

Bridge Loan Program

Interim financing for most commercial real estate asset classes.

Institutional & Private Equity Program

We seek to deploy institutional & private equity by investing into opportunistic commercial real estate and commercial mortgage note purchases.

SBA 7a Loan Program

Government guaranteed commercial real estate loans up to $5,000,000.

Large Loan Interim Program

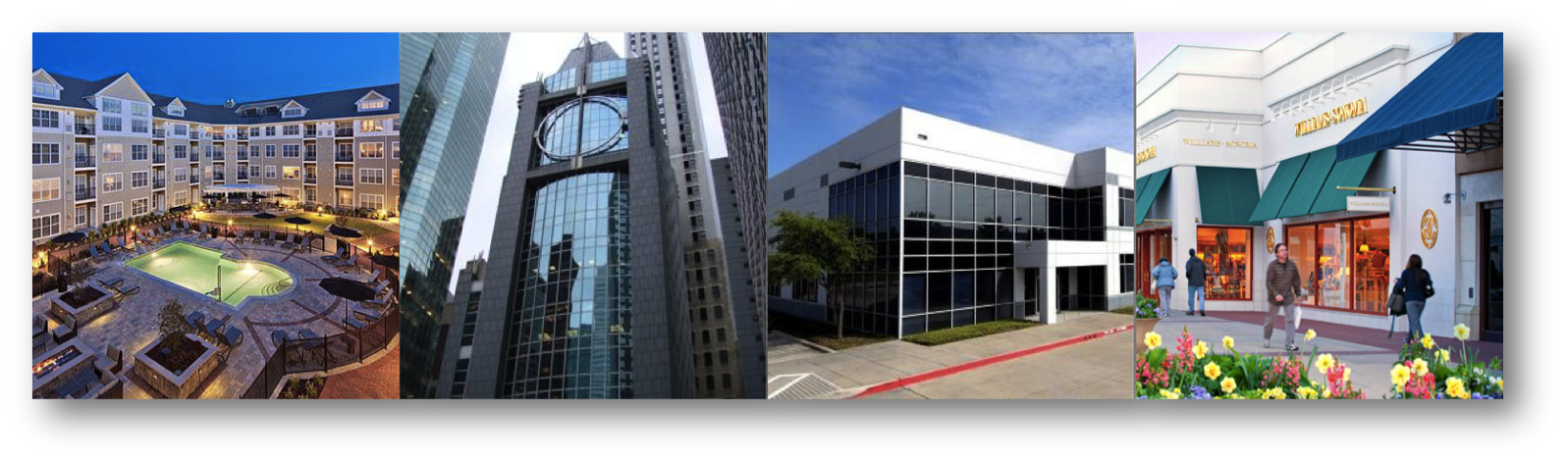

Commercial real estate finance for all Multifamily, Office, Retail, Hotel, Warehouse & Mixed-Use. Other assets considered depending on strength of exit strategy.

Permanent Loan Syndication Program

Traditional permanent financing provided by syndicating loans with Credit Unions, Commercial Banks and B Piece Investors.